Are You Expecting Social Security to Provide Your Retirement?

Dear Friend,

If the answer is no—and I’m sure it is—pay close attention. The following information could help you earn thousands of dollars in the coming years simply by increasing the yield on the money you’re already investing.

We are professional real estate investors, and we want to share a strategy that allows you to control your investments and grow them at three to five times your current rate. It might sound too good to be true—but it isn’t. This approach is well-known among savvy real estate investors and has been quietly used in cities across America for years.

Why Smart Investors Have Been Doing This for Years

Entire companies have been built around this strategy, and those who have mastered it have grown their wealth significantly. The key is that it’s a safe investment that produces high yields while offering both security and liquidity.

Why Smart Investors Have Been Doing This for Years

Entire companies have been built around this strategy, and those who have mastered it have grown their wealth significantly.

The key is that it’s a safe investment that produces high yields while offering both security and liquidity.

The Power of Increasing Your Yield

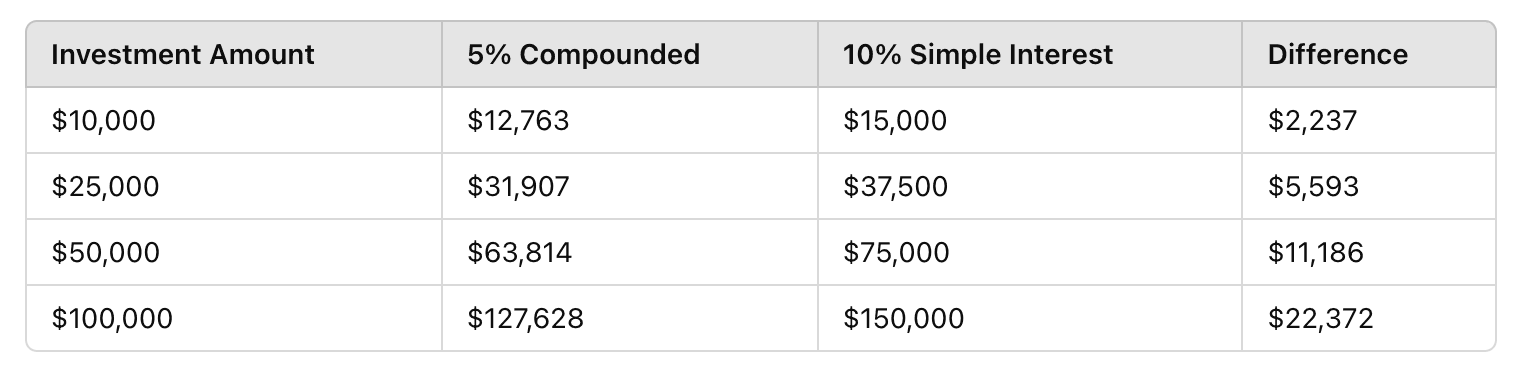

Let’s look at a simple example:

- $50,000 invested for 5 years at 5% compounded annually = $63,814.08

- $50,000 invested for 5 years at 10% simple interest = $75,000

Take Control of Your Investments

Instead of relying on low-yield CDs, savings, or pension plans, consider this:

✅ Earn 7%–12% interest instead of the average 2%–5%

✅ Use your IRA, pension plan, or savings to fund higher-yield investments

✅ Backed by real estate for security

Potential Growth Over 5 Years

👉 If you extend to 10 years, a $25,000 investment at 5% grows to $40,722—but at 10%, it grows to $50,000. That’s an extra $9,278—money you’d otherwise miss out on!

The Solution: Private Mortgage Loans

Private mortgage loans offer a way to:

✅ Earn higher yields (7%–12%)

✅ Secure your investment with real property

✅ Maintain liquidity and flexibility

How Private Mortgage Loans Work

You lend money to a real estate investor, and your loan is secured by the property they purchase.

Here’s why this works:

- Low Loan-to-Value (LTV): We target loans at 50%–75% LTV.

- Example: If a house appraises for $60,000, we might buy it for $45,000, keeping the loan at a 75% LTV for security.

- Unlike banks that lend at 80%–95% LTV, our approach gives you a safety cushion of 25%–50%

FAQs About Private Mortgage Loans

Who Borrows at High Rates?

We do—because for us, it’s about availability, not cost.

- Real estate investors rely on fast access to capital to secure deals.

- Paying a higher interest rate is worth it if it means securing a profitable deal.

What Kind of Loans Are These?

We do—because for us, it’s about availability, not cost.

- You lend directly to a real estate investor.

- The loan is secured by a first or second mortgage.

- Typical LTV: 60%–68% for added security.

Do I Need a Lot of Money?

- No! Loans start at $5,000, but we prefer minimum investments of $40,000 for first liens.

Who Handles the Details?

- We do!

- All loans are closed through a licensed title company with title and hazard insurance.

- We also cover flood insurance and loss of rent insurance for added protection.

How Do I Get Paid?

- You’ll receive a monthly interest check directly from HCG Properties.

What If I Need to Cash Out?

- You can liquidate within 2 weeks to a month—no penalties.

- Unlike a CD, you have flexibility without early withdrawal fees.

Is This Really as Safe as It Sounds?

Yes—because of these safeguards:

✅ Low LTV (50%–75%)

✅ First lien security

✅ Insured and properly documented

Is This a Mortgage Pool?

- No. You make the whole loan yourself and hold the lien.

- You are the bank.

Using Your IRA or Pension Plan

Did you know you can use your IRA or pension plan to fund private mortgage loans?

✅ Your loan grows tax-deferred.

✅ A Third-Party Administrator (TPA) can manage the loan.

✅ You control the terms and can maximize returns.

Next Steps: Take Control of Your Financial Future

This strategy puts you in control:

✅ Higher returns (7%–12%)

✅ Secured by real property

✅ Monthly cash flow

If you’re ready to explore higher-yield investments with security and flexibility, contact us today. Let us help you make your money work harder for you!

We’re here to help