Private Lending Explained

Private Lending Explained

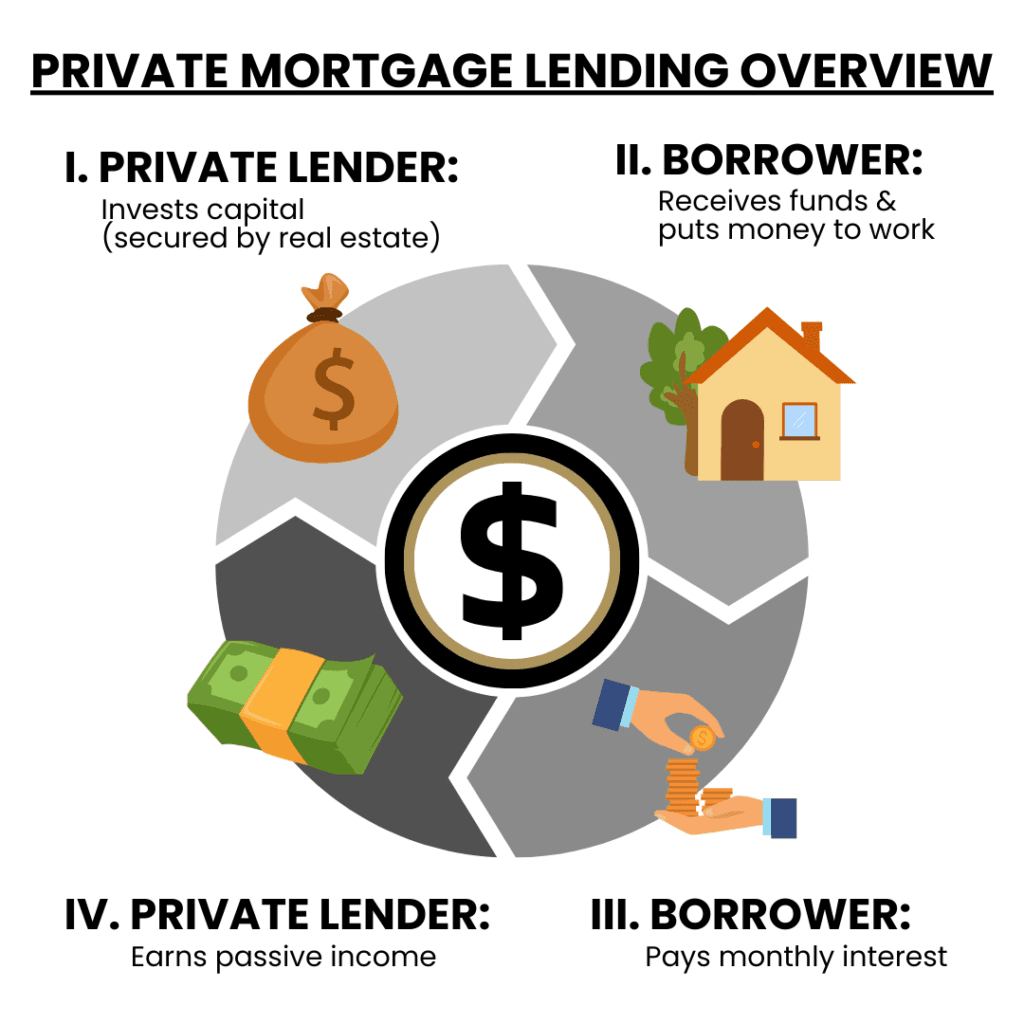

Private mortgage lending involves an individual lending their personal capital (such as cash or retirement funds) to another individual in exchange for an agreed-upon rate of return. These loans are typically secured by real estate, which can provide a level of collateral protection for the lender. However, as with any investment, proper structuring and due diligence are essential to managing risk.

Private mortgages offer potential benefits for both borrowers and lenders. Investors in private mortgages may receive interest rates that are higher than those typically offered by banks, while borrowers can access capital to complete their real estate transactions without the complexities of conventional financing.

Private lenders should approach their role much like a traditional mortgage company, carefully screening borrowers and properties to ensure they are making informed investment decisions. Conducting thorough due diligence is critical to mitigating risk and ensuring a secure transaction.

Private mortgage terms can vary widely. These loans may be structured for short-term periods (six months to two years) or long-term durations (two to ten years or more). Loan-to-value (LTV) ratios typically range between 50% and 75%, with interest rates often falling between 6% and 12%, though these figures can vary based on property type and market conditions. LTV ratios also often depend on the property type.

A lower LTV typically translates to lower risk, as it provides an equity cushion in case of borrower default.

Loan structures can also be tailored to meet the needs of both parties. Many private mortgages utilize simple interest (interest-only payments); however, lenders and borrowers may agree on other terms, such as amortized loans, deferred payments, or equity share arrangements (joint ventures). In equity share structures, the lender may receive a portion of the property’s profits upon sale in addition to their interest payments.

Borrowers who utilize private mortgages may also have the opportunity to build equity over time, particularly with fully amortized loans. In some cases, they may later refinance their mortgage at a lower interest rate through a conventional lender.

Important Disclaimer:

Private mortgage lending, like any investment, carries inherent risks. Investors should perform thorough due diligence on both the borrower and the property before engaging in any private lending agreement. It is also advisable to consult with legal, financial, and tax professionals to ensure compliance with applicable regulations and to align with individual investment goals.

For more information about private mortgage lending and to determine if it aligns with your investment strategy.